iOS app monetization has become the decisive factor for mobile application success, featuring 7 proven strategies: subscription models, in-app purchases, advertising revenue, freemium models, paid-upfront pricing, Apple Search Ads integration, and hybrid monetization approaches. These strategies not only generate revenue but also build sustainable foundations for long-term growth by optimizing Lifetime Value (LTV), minimizing Customer Acquisition Cost (CAC), and maintaining strict compliance with App Store guidelines. Crucially, implementing these strategies effectively within the context of App Tracking Transparency (ATT) and SKAdNetwork 4+ helps developers adapt to Apple's evolving privacy landscape while preserving profitability.

Sustainable iOS app revenue is defined through core KPIs including LTV/CAC ratio, Monthly Recurring Revenue (MRR), Net Revenue Retention (NRR), churn rate, and ARPDAU. Success requires understanding the distinctions between consumable/non-consumable IAPs and auto-renewable subscriptions, balancing eCPM with user experience in advertising, optimizing feature gating strategies for freemium models, and integrating Apple Search Ads with LTV-based bidding. The intelligent combination of multiple revenue streams in hybrid approaches provides risk resilience while maximizing revenue potential across different user segments.

Sustainable revenue from iOS apps represents recurring, predictable income streams with low volatility, diversified sources, and strict App Store compliance, measured through core KPIs including LTV, Net Revenue Retention (NRR), Monthly Recurring Revenue (MRR), churn rate, ARPDAU, and CAC payback period.

Sustainable revenue fundamentally differs from short-term spikes through its predictability and renewability. Lifetime Value (LTV) serves as the most crucial metric, representing the total expected net value a user generates throughout their app lifecycle. Net Revenue Retention (NRR) measures the ability to retain and expand revenue from existing customers, with NRR above 100% indicating successful growth through upselling and cross-selling.

Monthly Recurring Revenue (MRR) provides predictable monthly cash flow, particularly vital for subscription-based applications. The Customer Acquisition Cost (CAC) payback period determines the time required to recoup user acquisition investments, with optimal periods typically ranging 3-12 months depending on app category. ARPDAU (Average Revenue Per Daily Active User) measures monetization efficiency, providing quick insights into the impact of ads, IAP, or subscription changes.

According to RevenueCat's State of Subscription Apps Report 2024, applications with LTV/CAC ratios above 4:1 maintain sustainable growth in competitive markets, while ratios below 2:1 indicate unsustainable unit economics requiring immediate optimization.

Seven monetization strategies have proven most effective for iOS: subscription models, in-app purchases (IAP), advertising revenue, freemium models, paid-upfront pricing, Apple Search Ads integration, and hybrid monetization strategies, evaluated by LTV/CAC ratio, user retention, revenue predictability, and App Store compliance.

The subscription model leads in predictable revenue generation, particularly suitable for productivity apps, content platforms, and mobile SaaS solutions. In-app purchases demonstrate superior effectiveness in gaming and lifestyle applications through consumable and non-consumable items. Advertising revenue maintains significance post-ATT through contextual advertising, SKAdNetwork 4+ optimization, and rewarded video formats.

Yes, the subscription model generates the most sustainable recurring revenue through auto-renewable subscriptions, predictable cash flow, and higher lifetime value, typically achieving LTV/CAC ratios 3-5 times higher than one-time purchase models.

Auto-renewable subscriptions operate through automatic renewal mechanisms without user intervention, creating stable revenue streams and minimizing churn risk. Monthly subscriptions typically achieve higher conversion rates but experience higher churn, while annual subscriptions deliver better LTV and reduced processing fees. Free trials play crucial roles in conversion funnels, with optimal trial lengths typically 7-14 days depending on app category.

Intro offers including discounted first periods, trial extensions, or upfront discounts help lower barriers to entry and increase trial-to-paid conversion rates. StoreKit 2 provides Server Notifications v2 for accurate subscription status synchronization, reducing involuntary churn due to status misunderstandings.

In-App Purchases differ from subscriptions in payment frequency, user commitment, and revenue predictability: IAPs are one-time transactions with immediate value delivery, while subscriptions are recurring payments with ongoing value provision. IAPs require lower user commitment but demand constant engagement, whereas subscriptions offer higher predictability but show greater churn sensitivity.

Consumable IAPs like gems, coins, and credits are purchased and consumed immediately, creating repeat purchase opportunities but requiring continuous content creation. Non-consumable IAPs such as premium features, ad removal, and additional content provide permanent value but limit per-user revenue potential. Auto-renewable subscriptions combine recurring revenue with ongoing service delivery, making them ideal for content-heavy apps and productivity tools.

Revenue patterns differ significantly: IAP revenue often spikes around content releases or special events, while subscription revenue remains more stable with gradual growth trends. User psychology also varies: IAP users make conscious purchasing decisions for specific needs, while subscription users commit to ongoing relationships with service providers.

Yes, advertising revenue remains effective post-ATT through SKAdNetwork 4+ optimization, contextual advertising, first-party data utilization, and user-friendly rewarded formats, despite eCPM reductions of 15-30%, as fill rates improve through diversified ad networks and mediation optimization.

The ATT framework fundamentally changed mobile advertising with opt-in rates around 25-30% globally. However, advertisers and developers successfully adapted through privacy-focused strategies. SKAdNetwork 4+ provides improved attribution capabilities with multiple conversion values, enhanced postback timing, and crowd anonymity thresholds to balance privacy with measurement accuracy.

![]()

Rewarded video ads optimize for gaming apps, native ads suit content and news applications, interstitial ads work for utility apps, and banner ads fit productivity applications, based on user experience impact, engagement metrics, and eCPM potential.

Rewarded video ads in gaming applications achieve completion rates of 85-95% because users willingly engage to receive in-game rewards like extra lives, coins, or power-ups. Native ads blend seamlessly with content flow in news and social apps, maintaining user experience quality while delivering relevant advertiser messages. Interstitial ads perform best at natural breakpoints in app flow, such as between levels or after task completion.

Mediation platforms like AdMob, AppLovin MAX, and Unity LevelPlay optimize ad delivery through real-time bidding and waterfall optimization. Header bidding increases competition among ad networks, resulting in higher eCPMs and better fill rates.

According to the ironSource/Unity eCPM Index 2023, iOS rewarded video typically delivers the highest eCPM among formats due to voluntary user engagement and clear value exchange.

Balancing eCPM with user experience requires frequency capping (3-5 ads per session), strategic placement at natural breakpoints, user segmentation (paying vs. non-paying), A/B testing optimal ad density, and monitoring impact on session length and retention rates.

Frequency capping prevents ad fatigue and user annoyance, with optimal frequency typically 3-5 ads per user session depending on app category. Placement optimization involves identifying natural moments in user journeys where ads feel less intrusive. User segmentation allows reducing ad frequency for paying users to avoid cannibalizing IAP or subscription revenue.

Viewability metrics ensure ads are actually seen by users, improving advertiser satisfaction and long-term eCPM rates. Session length monitoring helps detect negative impacts from excessive ad exposure. A/B testing ad density, placement timing, and format mix provides data-driven optimization opportunities.

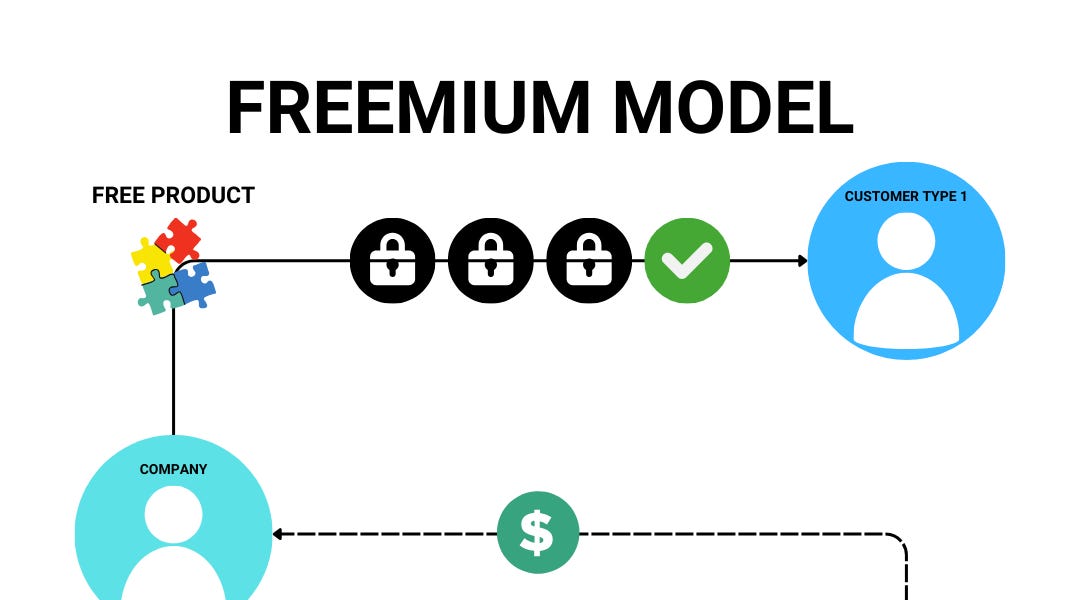

No, the freemium model suits only apps with strong network effects, scalable content value, clear feature differentiation, and the ability to demonstrate premium value through free tier usage. Success factors include viral coefficients >1.0, conversion rates of 2-5%, and sustainable unit economics for free users.

The freemium model succeeds when free tiers provide genuine value while creating natural upgrade motivation. Network effects amplify user value as more people join platforms, making premium features more attractive. Content-heavy apps benefit from freemium because users can sample content quality before committing to paid subscriptions.

Soft paywall strategies prove most effective with conversion rates of 8-12%: usage-based limits (5 articles/month), feature restrictions (basic vs. advanced tools), capacity limitations (storage, exports), and time-based access (premium content delays).

Soft paywalls allow users to experience value before hitting limitations, creating natural upgrade moments. Hard paywalls block access immediately but achieve lower conversion rates of 2-4%. Metered usage works particularly well for content apps, allowing users to consume limited amounts before requiring subscriptions.

A/B testing methodologies for paywall optimization include testing paywall timing, messaging, pricing tiers, and visual design elements. Successful tests often focus on value proposition clarity, social proof, and reducing friction in upgrade processes.

According to RevenueCat data from 2024, apps conducting regular paywall A/B testing can increase trial-to-paid conversion by 20-30% compared to non-optimizing applications.

Yes, the paid-upfront model remains viable for specialized professional tools, premium games, and niche utilities with clear value propositions, strong brand recognition, and target audiences willing to pay for quality solutions.

Professional tools like design applications, developer utilities, and specialized calculators maintain successful paid-upfront models because target users understand and appreciate immediate value. Premium games with no ads and complete content appeal to users seeking uninterrupted experiences.

Strategies to overcome download barriers include compelling app previews, strong social proof through reviews, limited-time pricing, and clear differentiation from free alternatives. App Store optimization becomes crucial for communicating value within limited space.

Yes, Apple Search Ads integrates effectively with monetization strategies through LTV-based bidding, keyword targeting aligned with user intent, and campaign structure optimization for different subscription tiers, achieving average ROAS of 200-400% for well-optimized campaigns.

Apple Search Ads provides high-intent traffic because users actively search for specific solutions. LTV-based bidding enables sustainable CAC by bidding up to profitable thresholds based on historical user value. Campaign structure should align with monetization funnels: broad campaigns for brand awareness, exact match campaigns for high-converting keywords.

Campaign structure for different monetization models requires tailored approaches: subscription apps focus on premium feature keywords, IAP-based games target gameplay-specific terms, and ad-supported apps can bid more broadly to maximize DAU. Creative Sets enable segment-specific messaging aligned with monetization goals.

Partnerships and affiliate marketing must strictly comply with App Store guidelines 3.1.x: physical goods partnerships are permitted, digital content must use Apple's payment system, and revenue sharing with third parties is limited by Apple's 15-30% commission considerations.

Physical goods marketplaces like Amazon integration or local delivery services can bypass Apple's payment system because they involve real-world fulfillment. Digital content partnerships must route through App Store billing unless qualifying for specific exceptions like reader apps with External Link Entitlement or multiplatform services.

Revenue sharing models need to account for Apple's commission in financial planning. Successful partnerships focus on value-added services and user acquisition rather than simple revenue splits.

Yes, hybrid monetization strategies optimize total revenue through revenue stream diversification, user segment optimization, and risk mitigation, with apps using 2-3 monetization models achieving 25-40% higher ARPU compared to single-model approaches.

Hybrid approaches capture value from different user behaviors: subscriptions for engaged users, IAPs for occasional spenders, and ads for free users. Risk diversification protects against policy changes, market shifts, or seasonal fluctuations in individual revenue streams. Mediation and cross-promotion between revenue streams create synergy effects.

Leading indicators proving sustainability include trial-to-paid conversion >3%, D1/D7/D30 retention >40%/20%/10%, and payback periods <6 months. Lagging indicators include LTV/CAC ratio >3:1, Net Revenue Retention >100%, and monthly churn <5%.

Cohort analysis reveals long-term user behavior patterns and revenue sustainability trends. Payback period tracking ensures acquisition spending remains profitable. Churn cohort analysis identifies at-risk user segments and optimization opportunities. ARPDAU trends by cohort show monetization health across different user acquisition channels.

Mastering iOS app monetization requires strategic implementation of the 7 proven strategies while maintaining focus on sustainable revenue generation. Success depends on understanding your app's unique value proposition, target audience behavior, and selecting the optimal mix of monetization models while ensuring strict App Store compliance.

The key metrics—LTV/CAC ratio >3:1, sustainable retention rates, and healthy conversion funnels—serve as north stars for building truly sustainable revenue streams. As privacy regulations evolve and the mobile ecosystem continues changing, developers who master these foundational strategies while staying adaptable to new technologies like SKAdNetwork 4+, contextual advertising, and first-party data collection will maintain competitive advantages in the iOS monetization landscape.

Strategic focus on user value delivery, privacy compliance, and data-driven optimization ensures long-term success in an increasingly sophisticated and regulated mobile app economy.

* * * <a href="http://motorolapromocionesmm.com/index.php?r2l1y2">$3,222 credit available</a> * * * hs=1b8fca2c478824163eb91a57c26fcd6d* ххх*

03:28 01/11/2025* * * $3,222 deposit available! Confirm your transaction here: http://motorolapromocionesmm.com/index.php?r2l1y2 * * * hs=1b8fca2c478824163eb91a57c26fcd6d* ххх*

03:28 01/11/2025IOS services

IOS app reviews IOS app installs IOS keyword installs Optimize iOS app Guaranteed top keyword iOS appRelated POSTS

Leave a Reply

Your e-mail address will not be published. Required fields are marked *